Learning Centre

Housing is still one of the best investments in Canada

Purchasing a home is still one of the most popular types of investments in Canada. Because of that, it is not a surprise that many Canadians were fearful with the abrupt economy reversal that happened recently. With the pandemic and the economy hit, the country’s...

Rent Statistics for June 2020

According to Rentals.ca, the average rental properties listed in May was $1,814 per month. This indicates a drop of 1.4% monthly and 5.4% annually. In May, the average rental rate was $1,750 per month, which a drop of $50 com pared to April 2020 and May 2019. The...

Canada Mortgage and Housing Corporation is changing their approval policies

Canada’s economy was affected in all sectors due to the COVID-19 pandemic, specially the housing sector. Plenty factors impacted negatively the housing market, including employees being laid off, unexpected business closures and a high decrease in immigration. Canada...

Canada Housing Market Sales warmed up 53% from April 2020

June 3, 2020 The housing market in Canada started to finally warm up again, after a long pause since the COVID-19 pandemic started. The predictions are overly optimistic according to the real state board, as long as the economy continues to re-open slowly and there...

Client is charged $30,000 in mortgage fees by TD Bank and is forced to sell her home during the pandemic

– June 1, 2020 Kristina Barybina is a real state agent and, when the pandemic happened, she knew that she had no choice but to sell her home since her income became inexistent. She was also aware that she would have to pay for a fee for ending the mortgage with TD...

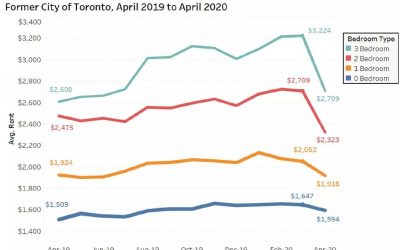

Here are the Toronto areas where rent prices notably dropped

The rent prices in Toronto keep dropping while the global pandemic continues. This happened for several reasons, since demand dropped significantly and some residents decided that this is not the best time to seek for another home. In addition to that, some landlords...

COVID 19 effect on mortgages: Interest rates go down, while mortgage rates aren’t

Benchmark interest rates are plummeting globally in response to COVID-19 crisis. Rates are being dropped in hopes to stimulate economies by making it easier to borrow and spend. But interestingly, in Canada mortgage rates aren’t really plummeting as much as some...

Changing the Mortgage Stress Test – FAQ

Have you heard about the changes proposed for the mortgage stress test? The big date is close – April 6 th , 2020! What is this change exactly? How would it benefit me? Find the answers to all your questions in our FAQ. Big news shook the mortgage world last week. The...

What you need to know about Trudeau’s first time home-buyer incentive

Are you a first time homebuyer looking to lower your monthly payments? The government's First-Time Home Buyer Incentive (FTHBI) was designed for prospective home owners like you. The incentive was introduced by the Federal Government in 2019 with the goal of improving...

The Qualifying Rate for the Mortgage Stress Test may change

A representative at the Office of the Superintendent of Financial Institutions (OSFI) mentioned that the use of Canada’s benchmark rate with regards to the stress test is currently being reviewed. What could that mean for Canadian home owners? Uninsured mortgages with...